Chick-fil-A Antibiotic Transition from NAE to NAIHM

|

|

Chick-fil-A has dropped the strict No Antibiotics Ever (NAE) to a modified No Antibiotics Important to Human Medicine (NAIHM). The Company has not specified the compounds that will be allowed but if this includes ionophore anticoccidial there will be a benefit to producers with no adverse effect for consumers. Ionophores are not regarded as “antibiotics” in the E.U. but because the compound suppresses some intestinal bacteria they were unjustifiably included as “antibiotics”, with respect to the FDA classification. If the Chick-fil-A standard allows the use of feed additive bacitracin, there will be no deleterious effect since this compound is not used for human medicine other than as a topical application and does not contribute to the emergence of antibiotic resistance. Inclusion of bacitracin in broiler diets will suppress Clostridium spp. responsible for necrotic enteritis and gangrenous dermatitis. Chick-fil-A has dropped the strict No Antibiotics Ever (NAE) to a modified No Antibiotics Important to Human Medicine (NAIHM). The Company has not specified the compounds that will be allowed but if this includes ionophore anticoccidial there will be a benefit to producers with no adverse effect for consumers. Ionophores are not regarded as “antibiotics” in the E.U. but because the compound suppresses some intestinal bacteria they were unjustifiably included as “antibiotics”, with respect to the FDA classification. If the Chick-fil-A standard allows the use of feed additive bacitracin, there will be no deleterious effect since this compound is not used for human medicine other than as a topical application and does not contribute to the emergence of antibiotic resistance. Inclusion of bacitracin in broiler diets will suppress Clostridium spp. responsible for necrotic enteritis and gangrenous dermatitis.

It  will be interesting to observe consumer response to the change in policy that will probably rise to the level of a large yawn. This will hold providing the chain maintains quality and value and can assure customers of ongoing welfare in production that conforms to the NCC standards. will be interesting to observe consumer response to the change in policy that will probably rise to the level of a large yawn. This will hold providing the chain maintains quality and value and can assure customers of ongoing welfare in production that conforms to the NCC standards.

The action by Chick-fil-A parallels the earlier announcement by Panera Bread and could initiate a trend among QSRs and mid-priced supermarket chains to adopt a more realistic policy on antibiotics consistent with scientific and financial realities.

|

Chicken Walnut Salad Recalled

|

|

Taylor Farms has recalled ten tons of ready-to-eat apple walnut chicken salad due to non-label disclosure of wheat. Affected product was manufactured between February 28th and March 9th and marketed in Kroger stores in twelve western states. Taylor Farms has recalled ten tons of ready-to-eat apple walnut chicken salad due to non-label disclosure of wheat. Affected product was manufactured between February 28th and March 9th and marketed in Kroger stores in twelve western states.

Product recalls are usually attributed to contamination with pathogens, the presence of foreign material or improper labeling. Misbranding involving the inclusion of a non-declared allergens is a self-inflicted wound and can be avoided by appropriate quality control and coordination within a company. Product recalls are usually attributed to contamination with pathogens, the presence of foreign material or improper labeling. Misbranding involving the inclusion of a non-declared allergens is a self-inflicted wound and can be avoided by appropriate quality control and coordination within a company.

|

Freirich Foods Files for Bankruptcy Protection

|

|

Freirich Foods, a family-owned enterprise established in 1921, recently filed for Chapter 11 bankruptcy protection. This action was taken following a $7 million loss arising from 1.2 million pounds of product that was mishandled by a third-party cold storage company. Freirich Foods, a family-owned enterprise established in 1921, recently filed for Chapter 11 bankruptcy protection. This action was taken following a $7 million loss arising from 1.2 million pounds of product that was mishandled by a third-party cold storage company.

The filing will allow the company to restructure finances, maintain solvency and to restore profitability for the benefit of the owners, creditors and indirectly, 100 workers.

In a statement, the CEO noted, “Bankruptcy protection will enable our company to safeguard our business, employees, customers, and partners while we seek to recover our financial loss and propose a plan to restructure debt and renegotiate contracts. We will emerge from this process with a stronger balance sheet”. In a statement, the CEO noted, “Bankruptcy protection will enable our company to safeguard our business, employees, customers, and partners while we seek to recover our financial loss and propose a plan to restructure debt and renegotiate contracts. We will emerge from this process with a stronger balance sheet”.

It is questioned whether the company can recover the loss through insurance or a lawsuit alleging negligence.

|

Department of Labor Aggressively Investigating Child Labor

|

|

The Department of Labor has filed lawsuits against three California poultry processors alleging violations of child labor law. The Wages and Hours Division has been reviewing plant employment records and conducting inspections uncovering “oppressive child labor at poultry processing facilities.” According to the submissions by the Department of Labor the three companies concerned employed children under the age of 18 to debone poultry in contravention of child labor laws. The Department of Labor has filed lawsuits against three California poultry processors alleging violations of child labor law. The Wages and Hours Division has been reviewing plant employment records and conducting inspections uncovering “oppressive child labor at poultry processing facilities.” According to the submissions by the Department of Labor the three companies concerned employed children under the age of 18 to debone poultry in contravention of child labor laws.

Defendants include L&Y Food Inc., Moon Poultry Inc. and JCR Culinary Group Inc. and their three respective managers in their personal capacities.

The Department of Labor was granted an injunction embargoing products from the plants although there was evidence that the restraining order was defied. The Agency alleged that the defendants obstructed investigations including review of employment data.

|

Contractor Lawsuit Dismissed

|

|

A July 2022 lawsuit filed in Federal court in Georgia against Perdue Farms was recently dismissed. Roger Parker the Plaintiff, claimed misclassification as an “independent contractor” and that the Company retaliated by terminating his contract for registering complaints under the Packers’ and Stockyards Act. The Plaintiff, also claimed improper compensation due to under-weighing of broilers delivered. A July 2022 lawsuit filed in Federal court in Georgia against Perdue Farms was recently dismissed. Roger Parker the Plaintiff, claimed misclassification as an “independent contractor” and that the Company retaliated by terminating his contract for registering complaints under the Packers’ and Stockyards Act. The Plaintiff, also claimed improper compensation due to under-weighing of broilers delivered.

Parker held that since contractors are “treated like employees” they should receive employee benefits including overtime. This is a somewhat fallacious characterization given the nature of the relationship between the contractor who supplies housing, labor and utilities and the integrator providing chicks and feed and extending service as defined in the contract.

Parker was unable to establish a Class for the lawsuit as he faced understandable lack of interest among contractors willing to participate in the litigation.

|

Hormel Foods Agrees to $11.7 Million Settlement

|

|

Hormel Foods has agreed to pay three classes of Plaintiffs in a suit alleging collusion on pork prices. Commercial indirect purchasers will receive $2.4 million, direct pork purchasers, $4.8 million and consumer indirect purchasers, $4.5 million. Hormel Foods has agreed to pay three classes of Plaintiffs in a suit alleging collusion on pork prices. Commercial indirect purchasers will receive $2.4 million, direct pork purchasers, $4.8 million and consumer indirect purchasers, $4.5 million.

Collectively, there were 146 claimants in 27 cases that were consolidated during December 2022.

The settlement by Hormel Foods follows a June agreement by Seaboard Foods to pay the class of direct purchasers $9.8 million to settle the lawsuit.

|

Tyson Foods Responds to Questionable Claim by Cody Easterday

|

|

Cody Easterday currently serving an 11-year prison sentence for defrauding Tyson Foods of $144 million has filed suit against the Company. At issue, is a claim that Easterday was offered a share of the profits from sales of meat products designated “Cody’s Beef” marketed in Japan. Cody Easterday currently serving an 11-year prison sentence for defrauding Tyson Foods of $144 million has filed suit against the Company. At issue, is a claim that Easterday was offered a share of the profits from sales of meat products designated “Cody’s Beef” marketed in Japan.

Cody claimed $100 million for using his name and image on product labels. His original filing with the U.S. Court of Appeals for the Ninth Circuit was dismissed but Easterday is persisting in his litigation. Tyson Foods categorically rejects the claim based on the absence of any proof relating to any obligation by Tyson Foods to share in profits.

|

Costco Changes Packaging for Rotisserie Chicken

|

|

Costco is undertaking a five-year action plan to reduce the use of plastic packaging. The company markets close to 150 million rotisserie chickens annually, currently presented in two-part PET containers. Following test in Canada, the Company has introduced a flexible plastic bag with insulating capability for their chickens. The change will reduce plastic use for this application by 75 percent, representing a saving of 17 billion pounds of resin annually and a reduction of 4,000 metric tons of carbon dioxide released. This, according to a Company claim will be equivalent to the output of 1,000 trucks annually when fully implemented across 850 warehouses globally. Costco is undertaking a five-year action plan to reduce the use of plastic packaging. The company markets close to 150 million rotisserie chickens annually, currently presented in two-part PET containers. Following test in Canada, the Company has introduced a flexible plastic bag with insulating capability for their chickens. The change will reduce plastic use for this application by 75 percent, representing a saving of 17 billion pounds of resin annually and a reduction of 4,000 metric tons of carbon dioxide released. This, according to a Company claim will be equivalent to the output of 1,000 trucks annually when fully implemented across 850 warehouses globally.

Tim Wahlquist responsible for Costco packaging stated, “The goal is to reduce packaging waste while still protecting products, ensuring food safety and complying with laws and regulations. As a corporate policy, Costco will replace plastic packaging with potentially recyclable content as feasible alternatives become available.

|

Integrators Settle Over Wage Claims

|

|

Case Foods and Mountaire Farms have agreed to pay $8.5 million and $13.5 million respectively to the class of workers alleging collusion in setting wage rates. Case Foods and Mountaire Farms have agreed to pay $8.5 million and $13.5 million respectively to the class of workers alleging collusion in setting wage rates.

The lawsuit was filed in 2019 and claimed interaction among employers to agree on wage rates and to indirectly share information through AgriStats®.

Recently Perdue Farms settled for $60 million, but there are eighteen integrators still named as defendants.

|

Proposed California Ban on Locomotive Emissions Opposed

|

|

The California Air Resources Board (CARB) has requested the EPA to allow California to issue regulations to limit emissions by locomotives. The proposed requirements would include:- The California Air Resources Board (CARB) has requested the EPA to allow California to issue regulations to limit emissions by locomotives. The proposed requirements would include:-

- Decommissioning of locomotives older than 23 years at the beginning of 2030,

- Impose reporting requirements and administrative fees

- Require railroads to shut down other than zero-emission locomotives when transiting in certain areas.

The proposal has resulted in considerable opposition including the National Chicken Council and ninety federal and state agencies and infrastructure associations. A joint letter to the Director of the EPA stated, “If the CARB regulations are authorized by EPA, we believe freight rail carriers and their customers would be significantly hindered financially and operationally”. Clearly the proposed requirements presume technology that is currently unavailable or will be impractical to implement.

The proposed CARB restrictions appear to be preempted by federal law that allows the Surface Transportation Board to exercise jurisdiction over the operation and activities of freight railroads in interstate commerce.

Subscribers will recall the difficulties encountered by Foster Farms in obtaining adequate quantities of corn due to reduced rail transport during COVID and 2023 labor action against railroad operators, resulting in litigation and appeals to the Surface Transportation Board.

|

India to Allow Importation of Duck Meat

|

|

According to USDA-FAS GAIN report IN2024-0015 released on March 25th India will allow importation of duck meat. During early March, the Ministry of Commerce and Industry authorized imports of premium frozen duck meat in accordance with a harmonized tariff system. According to USDA-FAS GAIN report IN2024-0015 released on March 25th India will allow importation of duck meat. During early March, the Ministry of Commerce and Industry authorized imports of premium frozen duck meat in accordance with a harmonized tariff system.

Import duties for duck meat have been reduced with expectations of shipments to the Nation from the U.S albeit it in competition from producers in the E.U. and Asian nations including Thailand and China. Import duties for duck meat have been reduced with expectations of shipments to the Nation from the U.S albeit it in competition from producers in the E.U. and Asian nations including Thailand and China.

|

KFC Introducing Saucy Nuggets

|

|

KFC has introduced five new sauces for their white-meat chicken nuggets. Priced at $5.99 for ten, Saucy Nuggets are available with one of three new flavors and two held over by demand. They include honey sriracha, Korean BBQ, sweet and sour, natural hot and Georgia gold honey mustard. KFC has introduced five new sauces for their white-meat chicken nuggets. Priced at $5.99 for ten, Saucy Nuggets are available with one of three new flavors and two held over by demand. They include honey sriracha, Korean BBQ, sweet and sour, natural hot and Georgia gold honey mustard.

|

Risk Assessment Recommends Concentration on Virulent Salmonella Serotypes

|

|

A recent study by Dr. Matthew Stasiewicz at the University of Illinois indicated that regulatory concentration on high levels of known virulent Salmonella serotypes would benefit public health. To date, Salmonella standards have been based on prevalence resulting in an evident reduction in recovery from processed poultry. Unfortunately there has not been a corresponding reduction in the incidence rate of chicken-related salmonellosis among consumers. A recent study by Dr. Matthew Stasiewicz at the University of Illinois indicated that regulatory concentration on high levels of known virulent Salmonella serotypes would benefit public health. To date, Salmonella standards have been based on prevalence resulting in an evident reduction in recovery from processed poultry. Unfortunately there has not been a corresponding reduction in the incidence rate of chicken-related salmonellosis among consumers.

The risk assessment concluded that specific products with high levels of pathogenic serotypes should receive attention in order to develop appropriate control modalities. Dr. Stasiewicz suggested that programs focusing on generic prevalence of Salmonella may contribute to the emergence of more pathogenic serotypes such as Salmonella Kentucky. The risk assessment concluded that specific products with high levels of pathogenic serotypes should receive attention in order to develop appropriate control modalities. Dr. Stasiewicz suggested that programs focusing on generic prevalence of Salmonella may contribute to the emergence of more pathogenic serotypes such as Salmonella Kentucky.

The risk assessment was supported by a grant from the USPOULTRY Foundation.

|

Federal Agencies Issue MOU on Animal Welfare

|

|

The Environmental and Natural Resources Division of the Department of Justice (DOJ); the USDA Animal and Plant Health Inspection Service (APHIS) and the USDA Office of General Counsel have issued a Memorandum of Understanding (MOU) on civil and judicial implementation of the Animal Welfare Act. In the event of an overlap among federal agencies, MOUs designate the relative jurisdiction and responsibilities and coordination of activities including the sharing of information and enforcement. The Environmental and Natural Resources Division of the Department of Justice (DOJ); the USDA Animal and Plant Health Inspection Service (APHIS) and the USDA Office of General Counsel have issued a Memorandum of Understanding (MOU) on civil and judicial implementation of the Animal Welfare Act. In the event of an overlap among federal agencies, MOUs designate the relative jurisdiction and responsibilities and coordination of activities including the sharing of information and enforcement.

Following an infraction of the Animal Welfare Act the Federal government can implement civil action through the DOJ requiring federal district court action. In most cases, the APHIS can pursue administrati ve enforcement that can involve a warning with a settlement agreement with or without imposing a monetary penalty. APHIS has the authority to suspend or revoke licenses, issue cease-and-desist orders and impose civil penalties through the administrative law process. ve enforcement that can involve a warning with a settlement agreement with or without imposing a monetary penalty. APHIS has the authority to suspend or revoke licenses, issue cease-and-desist orders and impose civil penalties through the administrative law process.

The MOU establishes a priority for repeat offenders and egregious violators. Plants that will receive attention include facilities with a history of multiple citations or involving noncompliance. Licensees considered for suspension will have previously denied inspectors access or operate with defective records or exhibit a pattern of interference with inspectors. The MOU will facilitate coordinated action by the agencies involved.

The MOU is probably a response to a petition by animal rights and welfare organizations to allow local law enforcement and judicial agencies to intervene in cases of alleged deviations from the Animal Welfare Act. The MOU is probably a response to a petition by animal rights and welfare organizations to allow local law enforcement and judicial agencies to intervene in cases of alleged deviations from the Animal Welfare Act.

Additional information can be obtained from the APHIS website www.aphis.usda.gov/awa/enforcement

|

Veterinary Welfare Association Supports Petition to FSIS

|

|

In September 2023, animal welfare association Animal Partisan filed a petition with FSIS urging local and state investigation and prosecution of overt abuse of livestock in abattoirs. The Veterinary Association of Farm Animal Welfare (VAFAW) supports the petition but deviates from Animal Partisan in maintaining that states do not have the right to supersede federal officials with respect to oversight of welfare. The VAFAW has requested the FSIS to interact with local and state agencies in the event of any deviations from the Federal Meat and Poultry Inspection Acts. In September 2023, animal welfare association Animal Partisan filed a petition with FSIS urging local and state investigation and prosecution of overt abuse of livestock in abattoirs. The Veterinary Association of Farm Animal Welfare (VAFAW) supports the petition but deviates from Animal Partisan in maintaining that states do not have the right to supersede federal officials with respect to oversight of welfare. The VAFAW has requested the FSIS to interact with local and state agencies in the event of any deviations from the Federal Meat and Poultry Inspection Acts.

USDA inspectors are empowered to close plants by suspending inspection in the  event of abuse. Referring cases to local or state officials is a reasonable action and could serve to strengthen welfare by focusing management attention on this aspect of plant operations. event of abuse. Referring cases to local or state officials is a reasonable action and could serve to strengthen welfare by focusing management attention on this aspect of plant operations.

|

USPOULTRY Approve Research Projects

|

|

In an April 8th release, USPOULTRY and the USPOULTRY Foundation approved funding amounting to $363,000 for three research projects dealing with poultry meat production. These comprised: - In an April 8th release, USPOULTRY and the USPOULTRY Foundation approved funding amounting to $363,000 for three research projects dealing with poultry meat production. These comprised: -

- Necrotic enteritis in chickens: understanding the immunological basis of host immunity North Carolina State University

- Cross-sectional and longitudinal epidemiologic investigations of Ornithobacterium in commercial turkeys. Iowa State University

- Technology for poultry hatcheries to simultaneously deliver vaccines and prebiotics. University of Delaware

|

E.U. Broiler Production in 2024

|

|

According to USDA-FAS GAIN Report E42024-06 released on February 27th, projected broiler production among E.U. nations will increase by 0.8 percent from calendar 2023 to 11.11 million metric tons. Imports will attain 750,000 metric tons representing 6.8 percent of production. Exports will rise to 1.67 million metric tons or 15 percent of production. Net exports will therefore represent 8.2 percent of production at 0.92 million metric tons. Given an E.U. population of 450 million, projected per capita consumption will amount to 22.6 kg (49.8 lb.) approximately half that of U.S. consumption. According to USDA-FAS GAIN Report E42024-06 released on February 27th, projected broiler production among E.U. nations will increase by 0.8 percent from calendar 2023 to 11.11 million metric tons. Imports will attain 750,000 metric tons representing 6.8 percent of production. Exports will rise to 1.67 million metric tons or 15 percent of production. Net exports will therefore represent 8.2 percent of production at 0.92 million metric tons. Given an E.U. population of 450 million, projected per capita consumption will amount to 22.6 kg (49.8 lb.) approximately half that of U.S. consumption.

Restraints to output include highly pathogenic avian influenza that has persisted since 2021. Other hindrances include environmental restraints with limits on nitrogen emissions in the Netherlands and Belgium. Although the price of ingredients has declined, production costs in France remain high and are limiting output. Economists forecast increase demand for chicken based on the competitive price and availability of pork and beef.

A major issue of contention is the importation of chicken from Ukraine without duty following E.U. regulation 2023/1077. Poland, the largest producer in the E.U. has requested limits on the importation of broiler products from their eastern neighbor.

Although the U.K. represents a strong market for E.U. chicken, supplied mainly from Poland and Germany, there is now increased supply from Brazil, Thailand and Ukraine. Competition from Brazil, the consistently low-cost supplier has eroded markets for the E.U. in Africa, the Middle East and especially South Africa.

|

Superior Farms Faces Denver Ballot Initiative

|

|

Superior Farms has operated within the city of Denver for decades. The company processes mutton and is the last remaining abattoir in the City that once was the terminal of cattle trails hosting extensive stockyards. A 2024 ballot initiative will determine the fate of the company in its present location. The proposed ordinance is intended to eliminate slaughtering operations in the City of Denver. The justification is not on the basis of nuisance, odor, pressure on effluent treatment as would be expected but is advanced by the deliberate misnomer of ‘welfare’. It is evident that the proponents of the ballot initiative are appealing to sentiment with the true agenda of veganism obscured by the concept of welfare. This is evidenced by the wording of the ballot that included “to promote community awareness of animal welfare, bolstering the City’s stance against animal cruelty and in turn to foster a more humane environment in Denver.” Superior Farms has operated within the city of Denver for decades. The company processes mutton and is the last remaining abattoir in the City that once was the terminal of cattle trails hosting extensive stockyards. A 2024 ballot initiative will determine the fate of the company in its present location. The proposed ordinance is intended to eliminate slaughtering operations in the City of Denver. The justification is not on the basis of nuisance, odor, pressure on effluent treatment as would be expected but is advanced by the deliberate misnomer of ‘welfare’. It is evident that the proponents of the ballot initiative are appealing to sentiment with the true agenda of veganism obscured by the concept of welfare. This is evidenced by the wording of the ballot that included “to promote community awareness of animal welfare, bolstering the City’s stance against animal cruelty and in turn to foster a more humane environment in Denver.”

Superior Farms slaughters lambs and processes carcasses through to case presentation. The plant employs 160, of whom 80 percent are Denver residents. Rick Stott, CEO maintains that despite polls showing even levels of either support or rejection “voters will resonate with a message of saying it’s not fair to target a particular business.” Superior Farms operates a facility in Dixon, CA.

Forced closure of the plant in Denver would reduce the supply of domestic lamb to the U.S. market that will simply be substituted by imports from New Zealand and Australia. Even if the ballot initiative fails the proponents will be back in two years. They recognize the vulnerability of Superior Farms and the publicity associated with an eventual victory. Success in pro-vegan ballots generates funding for the organizers and reinforces a feeling of self-satisfaction through aggressively promoting a lifestyle that is opposed to intensive livestock production.

|

Missouri Plant Protein Labeling Statute Upheld

|

|

The U.S. District Court for the Western district of Missouri ruled as constitutional the 2018 statute relating to potential misrepresentation of vegetable-based products as meat. The U.S. District Court for the Western district of Missouri ruled as constitutional the 2018 statute relating to potential misrepresentation of vegetable-based products as meat.

The Missouri statute, according to the court, did not prohibit commercial speech and was in accordance with the First Amendment. Turtle Island Foods, manufacturer of Tofurky, clearly labels its product as being ‘plant-origin’.

Missouri Attorney General, Andrew Bailey, stated, “Ensuring that the truth of products sold within the state of Missouri is of importance to both consumers and the farmers and ranchers that produce food.” The Missouri Cattlemen’s Association welcomed the judgment, noting “The legislation in no way prohibited the sale of consumption of these imitation products but it did require truthful and accurate labeling. Misleading consumers is unacceptable.” Missouri Attorney General, Andrew Bailey, stated, “Ensuring that the truth of products sold within the state of Missouri is of importance to both consumers and the farmers and ranchers that produce food.” The Missouri Cattlemen’s Association welcomed the judgment, noting “The legislation in no way prohibited the sale of consumption of these imitation products but it did require truthful and accurate labeling. Misleading consumers is unacceptable.”

Opponents of restricted legislation maintain that consumers are not confused by meat substitutes with labels that clearly indicate plant-based origin. These products are usually placed in display areas separate from animal-derived meat and with clear labeling of packages.

|

Brazil to Expand Production and Exports in 2024

|

|

According to USDA-FAS GAIN Report BR2024-0002, Brazil will increase broiler production to 15.10 million metric tons (33.22 million lbs.) of RTC, an increase of 1.3 percent over 2023. Of this total, 33.0 percent will be exported amounting to 4.975 million metric tons (10.94 million lbs.) or an increase of 4.3 percent over 2023. Assuming a population of 220 million, domestic per capita consumption will be 46.0 kg (101.3 lb.). According to USDA-FAS GAIN Report BR2024-0002, Brazil will increase broiler production to 15.10 million metric tons (33.22 million lbs.) of RTC, an increase of 1.3 percent over 2023. Of this total, 33.0 percent will be exported amounting to 4.975 million metric tons (10.94 million lbs.) or an increase of 4.3 percent over 2023. Assuming a population of 220 million, domestic per capita consumption will be 46.0 kg (101.3 lb.).

The GAIN Report noted that in 2023, feed cost representing 68 percent of live-bird cost declined by 22 percent with a corresponding 14 percent drop in chick cost representing 15 percent of live bird cost. The major increase was a 13 percent rise in the cost of electrical power that represented 2.5 percent of live bird cost.

With regard to exports, Brazil introduced electronic certification for the E.U. that will expedite approval of shipments and reduce cost. The Brazilian Association of Animal Protein (ABPA) noted expansion into new markets including Israel, the Pacific Islands and Algeria. In the case of this nation, Brazil donated 10,000 metric tons of chicken meat as a humanitarian gesture and to gain a foothold in the market.

For 2023, the top importers of chicken from Brazil comprised China (14 %); UAE (9%); Japan (9%); Saudi Arabia (8%) and South Africa (7%).

Brazil has apparently benefited from its status as “free of avian influenza in commercial farms”.

This situation is questioned since the nation reported 158 cases of H5N1 HPAI in backyard flocks and wild birds but miraculously none in commercial flocks. Eight states reported HPAI including all the major broiler producing areas.

|

Vegan Promoters Ambivalent over Florida Cultured Meat

|

|

Legislation banning the sale of cell-cultured meat in Florida, will take effect on July 1st, 2024. This legislation is essentially a “feel-good” measure in response to political pressure since there will not be any commercially available cell-cultured meat on July 1st, 2024, or for that matter, in the foreseeable future.

Vegan advocates consider that cell-cultured meat would be an improvement over conventional beef, pork and chicken based on welfare and environmental criteria. Organizations opposing  animal agriculture are also pushing the health aspects of non-meat diets citing an unproven scientific relationship between intake of dietary cholesterol and cardiovascular disease in otherwise healthy consumers. animal agriculture are also pushing the health aspects of non-meat diets citing an unproven scientific relationship between intake of dietary cholesterol and cardiovascular disease in otherwise healthy consumers.

|

Delmarva Producers to Improve Environmental Management Practices

|

|

The Delmarva Chicken Association and the Alliance for the Chesapeake Bay will fund a $2 million program over three years to promote best management practices for producers on the Delmarva Peninsula.

Funds will be used to improve riparian buffers and apply enhanced conservation, drainage and litter management. The intent is to reduce the release of nitrogen and phosphorous into Chesapeake Bay.

Participating farmers will be eligible for cost-share conservation initiatives including planting of trees, establishing pollinator areas between houses and around retention ponds. Participating farmers will be eligible for cost-share conservation initiatives including planting of trees, establishing pollinator areas between houses and around retention ponds.

|

Georgia Opposes U.S. EPA Effluent Guidelines

|

|

The Attorney General of Georgia, Chris Carr, has joined 26 other Attorneys General to oppose the Effluent Limitations Guidelines proposed by the U.S. Environmental Protection Agency. The Attorney General of Georgia, Chris Carr, has joined 26 other Attorneys General to oppose the Effluent Limitations Guidelines proposed by the U.S. Environmental Protection Agency.

Opposition to the proposed guidelines is based on the high cost of compliance that would increase the price of meat, poultry and egg products to consumers. It is estimated that with the more stringent guidelines, EPA jurisdiction over 150 processing plants would be increased to 3,000 facilities.

The letter submitted by the AGs noted “Evident escalation in the intensity of regulations issued by federal agencies, harms the integrity of our judicial system and this Administration should stop abusing the legal system to achieve results it otherwise cannot get”. Legality of the Effluent Limitations Guidelines is questioned since the proposed rule would extend the statutory authority of the Environmental Protection Agency under the Clean Water Act.

|

HPAI Continues in Taiwan

|

|

A ProMed report confirmed a recent outbreak of H5N1 avian influenza in Chang Hua County involving 20,000 hens that were depleted. Previous outbreaks have occurred in Ping Tang and Tainan in February. Since January “tens of thousands of hens” have been culled in Yunlin County resulting from exposure to H5N1 presumably from wild birds.

With numerous small and intermediate-sized duck and egg farms in close proximity and a live bird market system for broilers, Taiwan is candidate for vaccination against avian influenza H5N1. This is based on the location of the island nation on migratory bird routes and a history of recurring avian influenza suggesting a seasonal endemic status justifying protection.

|

Child Labor Persists in Contract Cleaning Sector

|

|

The U.S. Department of Labor has filed for a temporary restraining order on Fayette Janitorial Services, LLC to prevent employment of minors in plant-cleaning operations. According to documents submitted to the U.S. District Court for the northern district of Iowa, the company has employed minors in sanitation activities at plants in Iowa and Virginia. The U.S. Department of Labor has filed for a temporary restraining order on Fayette Janitorial Services, LLC to prevent employment of minors in plant-cleaning operations. According to documents submitted to the U.S. District Court for the northern district of Iowa, the company has employed minors in sanitation activities at plants in Iowa and Virginia.

A spokesperson for Perdue Farms that terminated the contract with Fayette prior to the Department of Labor action, stated, “Underage labor has no place in our business or in our industry. Perdue has strong safeguards in place to ensure that all associates are legally eligible to work in our facilities and we expect the same of our vendors.”

The Department of Labor is intent on enforcing federal law relating to employment of children in dangerous occupations and generally safeguarding workers.

Fayette Janitorial Services, LLC, based in Somerville, TN, operates in 30 states with 600 employees.

In addition to contravention of child labor laws, the investigation will also include possible trafficking and exploitation. If documented, cases will be referred to the Department of Justice.

|

Ukraine Chicken Industry Resilient During War

|

|

According to USDA-FAS GAIN Report, UP2024-0004, released February 22nd, chicken production in 2024 will expand by 3.1 percent to 1.340 million metric tons. Total imports will attain 52,000 metric tons and exports 440,000 metric tons with net exports representing 29 percent of production. Of the 952,000 metric tons for domestic use, per capita, will attain 26kg (57 lbs.) assuming a population of 37 million. According to USDA-FAS GAIN Report, UP2024-0004, released February 22nd, chicken production in 2024 will expand by 3.1 percent to 1.340 million metric tons. Total imports will attain 52,000 metric tons and exports 440,000 metric tons with net exports representing 29 percent of production. Of the 952,000 metric tons for domestic use, per capita, will attain 26kg (57 lbs.) assuming a population of 37 million.

Despite the invasion of Ukraine by the Russian Federation in 2022, the chicken industry has survived and expanded. This, in part, is due to the location of facilities in the central and western regions of the Nation together with the availability of grains at relatively low cost.

Production in Ukraine is dominated by MHP SE, responsible for 70 percent of output. This public-traded company has received loans through recent critical periods and enjoys the benefits of full integration from cultivation of feed ingredients, oil seed crushing, live production, processing and distribution. In addition to MHP, medium-sized producers include Agrooven, Dniprovskyi, Volldymyr-volynsk, PTA Hofabryka, Hubyn and Ular. Collectively, MHP and these companies are responsible for 90 percent of production.

Following the 2022 invasion, supply chains were disrupted and the Black Sea export route was closed. Labor availability was impacted by workers who volunteered for military service and as a result of conscription. During late 2022 and through 2023, infrastructure was repaired and the front line in the east of the nation was stabilized. Following the collapse of the Black Sea Grain Initiative, Ukraine established export capability through the coast-hugging Humanitarian Corridor and by rail transport. Currently exports are restrained by a shortage of refrigerated containers.

The E.U. is the main importer of chicken from Ukraine based on tariff-free and quota-free market access granted by the European Commission. Other factors favoring Ukraine include proximity to E.U. markets and a favorable production cost relative to Eastern Europe.

Europe intends to impose tariffs above a level of 160,000 metric tons although below exports to the E.U. in 2023. In the event that Ukraine becomes non-competitive above the free-trade level as a result of tariffs, the nation will explore export opportunities for exports to the Middle East.

|

Transition of JBS From PSSI Proceeding

|

|

Packers Sanitation Services Inc. (PSSI) has issued a warning notice to the state of Colorado that employees would be laid off following termination of the contract to clean plants for JBS including Greeley Co. JBS established an internal company cleaning service following the PSSI debacle over employment of under-aged workers. It is understood that the displaced PSSI workers will be engaged by JBS subject to eligibility.

PSSI paid a fine of $1.5 million and entered into a consent agreement with the Department of Justice. The CEO was replaced and the company appointed a qualified Compliance Officer. Notwithstanding these changes PSSI has lost revenue and it will take years to rebuild image and credibility in the industry.

|

|

|

Ministry of Agriculture in China to Regulate Sow Numbers

|

|

To prevent overproduction and to limit the importation of feed grains and soybeans, the Agricultural Ministry of China will place a cap on the number of sows in the national herd and the expansion of farms producing pork. Overproduction has reduced prices resulting in a sharp decline in imports. To prevent overproduction and to limit the importation of feed grains and soybeans, the Agricultural Ministry of China will place a cap on the number of sows in the national herd and the expansion of farms producing pork. Overproduction has reduced prices resulting in a sharp decline in imports.

The Ministry statement included, “the normal retention and fluctuation in the range of fertile sows in production, capacity reduction and other measures set in the previous regulatory plan are no longer well adapted to ensure stable feed production under the new situation.” The national target for breeding sows will be reduced from 41 million to 39 million. The Ministry statement included, “the normal retention and fluctuation in the range of fertile sows in production, capacity reduction and other measures set in the previous regulatory plan are no longer well adapted to ensure stable feed production under the new situation.” The national target for breeding sows will be reduced from 41 million to 39 million.

Overproduction of pork, the preferred animal protein in China, with correspondingly low prices is deleterious to domestic broiler production and imports. Rationalizing production should level the playing field to the benefit of processors and exporters.

|

Mineral Oil Contamination Leads to Recall

|

|

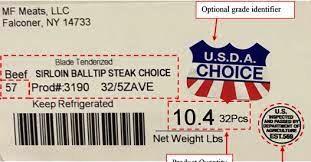

MF Meats located in Falconer NY. has recalled 46 tons of raw meat products contaminated with mineral oil disallowed by FSIS. Over the period November 26, 2023, through February 16, 2024, the Company used a nonapproved mineral oil in the place of food-grade lubricant due to an error made by a supplier. MF Meats located in Falconer NY. has recalled 46 tons of raw meat products contaminated with mineral oil disallowed by FSIS. Over the period November 26, 2023, through February 16, 2024, the Company used a nonapproved mineral oil in the place of food-grade lubricant due to an error made by a supplier.

The problem was recognized following complaints of abnormal taste leading to an investigation that disclosed the misapplication of mineral oil. It is evident that a proportion of the recalled meat has been consumed although there have been no reports of adverse reaction. As with all major recalls, FSIS will verify procedures relating to notification of customers and removal of affected the product from the market.

|

House of Raeford Planning New Plant in Aiken, SC.

|

|

The City Council of Aiken, SC. voted 6-1 to approve a procesOing plant to be built by House of Raeford. There was general acceptance of the project, but with some concern over the volume of water required and the treatment of effluent. Final approval will depend on passage of a water ordinance and approval of a tax agreement with Aiken County. The City Council of Aiken, SC. voted 6-1 to approve a procesOing plant to be built by House of Raeford. There was general acceptance of the project, but with some concern over the volume of water required and the treatment of effluent. Final approval will depend on passage of a water ordinance and approval of a tax agreement with Aiken County.

Predictably, the project has the support of the State of South Carolina since it will create employment opportunities for contractors and potential sales for farmers producing corn and soybeans.

|

Bezos Earth Fund to Invest $60 Million on Improving Plant-Based Meats

|

|

The Bezos Earth Fund will distribute grants to the value of $60 million to various research institutions including universities to improve the texture and taste of plant-based meat. This allocation will be part of a $1 billion fund intended to “transform the food industry”.

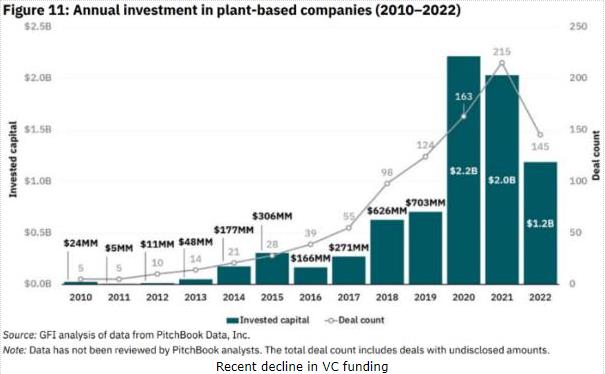

Proponents of plant-based meat alternatives now recognize the lack of consumer acceptance of the category characterized by declining sales. Producers of faux meat that publish financial reports confirm losses.

Andy Jarvis, Director of the Future of Food, at the Bezos Earth Fund, quoted in Bloomberg, observed that plant-based substitutes for meat “need to cost less and need to be more flavorful”. This is a tacit admission of the inferiority of current plant-based products and lack of variety despite higher prices.

|

Impossible Foods Introduces New Packaging Image

|

|

Peter McGuinness, president and CEO of Impossible Foods recently announced the introduction of new packaging at the National Products Expo West. McGuinness stated, “We want packaging that lived up to and reflected the deliciousness of our products while really popping on the shelf.” He added, “What we want to do is educate consumers that they can still enjoy meat by incorporating into their diet a version that’s made from plants instead of animals.” Peter McGuinness, president and CEO of Impossible Foods recently announced the introduction of new packaging at the National Products Expo West. McGuinness stated, “We want packaging that lived up to and reflected the deliciousness of our products while really popping on the shelf.” He added, “What we want to do is educate consumers that they can still enjoy meat by incorporating into their diet a version that’s made from plants instead of animals.”

McGuinness is clearly a marketing expert but appears to be insensitive to both accounting realities and the organoleptic properties of his products. Plant based meat alternatives are clearly inferior with respect to appearance, texture and taste. Shelf prices are higher than the product they purport to replace. Although Impossible Foods is not a publicly quoted company and therefore does not release financial reports, competitors Beyond Meat and the plant-based division of Maple Leaf Foods confirm non-profitability. McGuinness is clearly a marketing expert but appears to be insensitive to both accounting realities and the organoleptic properties of his products. Plant based meat alternatives are clearly inferior with respect to appearance, texture and taste. Shelf prices are higher than the product they purport to replace. Although Impossible Foods is not a publicly quoted company and therefore does not release financial reports, competitors Beyond Meat and the plant-based division of Maple Leaf Foods confirm non-profitability.

Impossible Foods should concentrate more on improving the quality of the product since the packaging is discarded and not eaten. The fact that the Bezos Earth Fund is making available grants to food science departments of universities to improve organoleptic qualities of plant-based foods confirms the reality of inferiority despite the Impossible Foods hype.

|